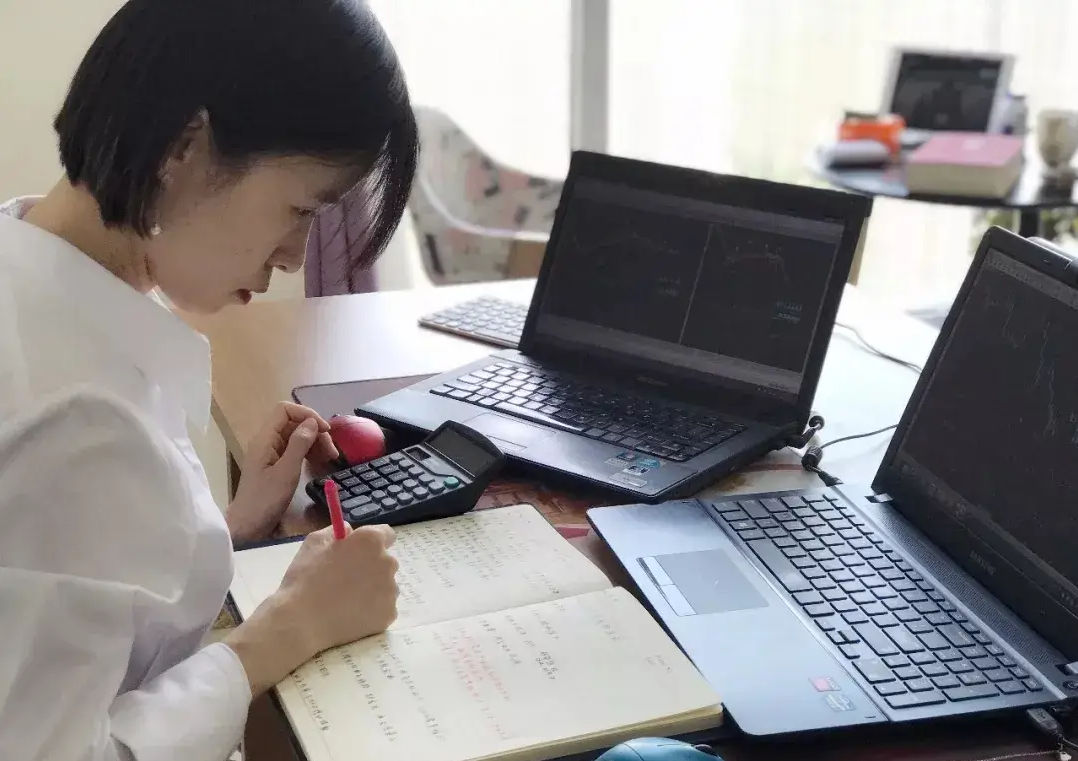

Transitioning from manual trading to employing expert advisors (EAs) has been a journey that has spanned nearly two years. Throughout this timeframe, I have faced numerous challenges, enduring significant emotional turmoil and physical exhaustion. Each obstacle and misstep contributed to my growth and learning, allowing me to accumulate invaluable experiences. Today, I wish to share this journey, summarizing the lessons learned and the various stages encountered along the way.

Beginning in March 2023, we initiated the testing and gradual adjustments of our EA, which has now been a continuous process for almost nineteen months. This period has been marked by countless hurdles and the necessity for multiple adjustments. More crucially, I have gone through numerous moments of systemic failures. Each failure plunged me into a deep state of confusion and fatigue, yet it was through these trials that I continuously refined and enhanced my trading strategies.

The trading model I implemented is fixed and was one I had utilized for almost a decade in my manual trading. Overall, it leans towards a trend-following strategy—this model is the bedrock of our EA. Trend strategies are characterized by their ability to generate substantial profits during unidirectional market movements. However, they often suffer consecutive losses during sideways or choppy market conditions, typically displaying low win rates coupled with high reward-to-risk ratios.

Transforming this trading model into one driven by algorithmic execution posed a series of formidable challenges. Extensive adjustments and adaptations were essential due to the inherent limitations of mechanical execution, which lacks the flexibility humans bring to trading. The absence of "negotiation" within systems helps mitigate extreme risks but also increases susceptibility to smaller losses. To navigate these challenges effectively, I focused on continuously optimizing the selection criteria, aiming for quantifiable and fixed parameters that would stabilize and enhance the predictability of final trading outcomes. The crux of this process was to enable the system to execute the pre-set rules with precision while minimizing uncertainties, gradually striving towards desired trading results.

Initially, I leaned on real-time signals to determine entry and exit points. This approach was sensitive and allowed me to capitalize on some of the more advantageous market points. However, the downsides were glaring—its excessive sensitivity often led to frequent entries and stop-loss triggers, particularly in trending scenarios, where short-term market fluctuations could mislead the model. After about a month of experiencing this volatility, I opted to retire this strategy, shifting instead to an approach based on confirmed close prices to dictate entry and exit strategies. This adjustment lowered the sensitivity of entries, sacrificing some ideal points in exchange for fewer trades and a higher win rate. Nevertheless, during this transition, I encountered my first substantial setback, suffering a consecutive loss across fifteen trades.

Indeed, through repeated experiences of systemic collapse, I gradually forged a more resilient mentality. The unique aspect of a trading system is the uncertainty about future success; ultimately, only faith can sustain one through tumultuous times. While groping in the dark, it is difficult to know whether an exit waits ahead, yet one cannot simply retreat and seek alternative paths. Each route demands perseverance through challenging phases. Even in the face of consecutive losses, maintaining belief in the model's validity is vital, attributing current misfortune solely to unfavorable market conditions.

In May of 2023, during the Labor Day holiday in China, I faced two shockingly volatile waves in the market, which resulted in substantial losses across several trades. Although the total number of losing positions was not overwhelmingly high, each held significant point losses. Once again, I found myself in a pit of despair. It became increasingly difficult to attribute the losses to market conditions or ineffective risk management. While on holiday, away from my computer, I watched helplessly as my account absorbed deep mini-losses. This experience further enriched my understanding of the market, especially regarding risk management, particularly as unpredictable volatile market movements pose an almost insurmountable challenge in avoiding losses.

From July to October 2023, the market remained relatively quiet, barely maintaining the integrity of the account without significant losses, allowing me to focus on accumulating experience and avoiding pitfalls. Following this period of relative stability, markets became more structured in September, offering clearer momentum that made trading more straightforward. Between September and October, I experienced a notable profit surge, with the account's performance jumping from a few percentage points to a remarkable 48% in a short span. During this time, my optimism soared, leading me to believe I had finally discovered the elusive rhythm of "easy gains."

However, the reality was stark; without sufficient trials and psychological strife, obtaining substantial results is virtually impossible. As profits climbed, so did my positions—my confidence swelled. Yet, a storm was imminent. Beginning at the end of November 2023, the market entered an extended phase of short-cycle volatility, completely obliterating the profits I had earned through smaller positions. My account suffered a drawdown of about one-third. The following six weeks left me questioning the purpose of my trades, with each position seemingly inversely timed—buying at peaks and selling at troughs, leading me to doubt my model's effectiveness and consider abandoning my current strategy altogether.

Fortunately, I managed to endure this tumultuous period. The term "endure" is particularly fitting here. After the Lunar New Year in 2024, the volatility began to settle; however, ideal trending markets remained elusive for the next two to three months, resulting in gradual account growth. In an effort to control risk, we intentionally decreased trading frequencies, implementing more stringent selection criteria to filter out signals. While this adjustment effectively controlled drawdowns, it also restricted potential profit opportunities. Thus, while stability improved, profits saw a marked decline, raising questions about the inherent trade-off between stability and profitability.

Eventually, we recognized that extending the trading cycle could be beneficial. By reducing the number of trades, we also minimized the chance for errors to occur. Additionally, longer cyclical trends have the potential to afford larger profit margins. Of course, this comes with its drawbacks, including reduced efficiency and a less smooth capital curve. To conduct more effective sample analyses, we needed to accumulate a greater volume of trading data over shorter timescales, which would grant a better understanding of overall performance. At the same time, we aspired for a smooth and stable capital curve.

From the onset of this journey, stability has remained our primary goal. As such, we contemplated adjusting our trading cycle to a 30-minute candlestick chart and shortening our trading windows to cover only the European and U.S. market hours. Trading outside of these windows would be avoided. This change provided several advantages: short periods allowed for more frequent opportunities, and missing potential trades outside these hours became less of a concern. With the shorter holding periods for trades, both stop-loss and take-profit thresholds were reduced. Consequently, when combined with our human-driven screening mechanisms, the overall loss magnitude diminished significantly, and while the profit margins were smaller, the frequency of entry opportunities increased, allowing for incremental profit accumulation—progress with minimal drawdowns remains preferable.

This strategy aligned well with our requirements for stable account performance; maintaining limited drawdowns while enabling steady profit growth became increasingly feasible. As long as one avoids harboring unrealistic ambitions for wealth, identifying one or two stable profit opportunities each week should be manageable. Under this framework, our overall model systematically stabilized, running effectively since July 2024 and successfully avoiding major pitfalls. Additionally, the capital curve became more refined, and returns reached favorable levels, averaging over 2% per week. Since these adjustments in July, we have refrained from making further changes, simply ensuring the system operates smoothly.

In summary, reflecting on this nearly two-year journey of trading, I have transitioned from manual practices to utilizing EAs, encountering countless challenges, setbacks, and moments of self-doubt while accumulating precious insights. Every aspect, be it system optimization, risk management adjustments, or navigating periods of market volatility, has embedded the understanding that trading encompasses not just technical skill but deeply involves psychological resilience and strategic adaptation.

I have unearthed a balance that combines human selection with the automation of EAs, minimizing emotional disruption while ensuring consistent execution and flexibility. Ultimately, the pathway to a relatively stable and sustainable trading model became clear, with effective drawdown management and gradual profit traction. This process instilled in me the understanding that successful trading relies not solely on the models and tools at our disposal, but rather upon trust in our strategies and insights into market conditions.

Leave A Reply